We’re pleased to have our very first guest post from a financial advisor on a money management topic, which has been offered to us by Rob Thorne, who is the owner of Thorne Financial Partners located in Bostonand Yarmouth Port on Cape Cod. Thanks to Matt Fitzsimmons, incoming co-chair of the Boston Bar Association’s Solo & Small Firm Section, for introducing me to Rob. For his initial guest post to the LOMAP Blog, Rob relays some thoughts on investment diversification, through which he hopes to encourage attorneys to save and invest thoughtfully and prudently.

. . .

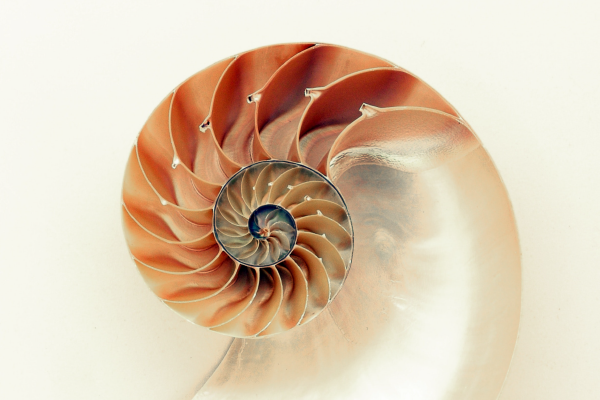

Think of investing as a venture into uncharted territory — you need to pack well in order to be successful. Don’t rely on a single investment vehicle to pursue your investment goals. Rather, build your portfolio with a selection of investments designed to work together. This method, of dividing your investment dollars among different types of investments, is called diversification. The theory is based on the concept that asset classes tend to react differently to market conditions. With a diversified portfolio of investments, you may help reduce the risk that a loss in one asset class will drag down your entire portfolio.

Diversity Within and Among Asset Classes

To diversify your retirement plan portfolio, select a mix of investments that are not too similar, but that will adequately tend to the pursuit of your overall investment objectives. First, try diversifying among different asset classes, such as stocks, bonds, and money market investment vehicles. Second, consider diversifying within an asset class, such as stocks. For example, if your primary objective is growth, you might choose to invest the majority of your money in ‘blue-chip’ stocks and small-capitalization stocks. You may also have the option of diversifying your portfolio with foreign investments. Foreign investments make up more than half of the world’s markets, so if you’re not investing overseas, you may be limiting your opportunities. Since U.S. markets may not move in lockstep with some overseas markets, foreign investments may be a good way to diversify. Foreign investing involves additional risks, however, including the risk of currency fluctuations, political upheavals, and higher taxation. Investors should carefully consider their ability to take on such risks before investing overseas.

Sometimes More Is Too Much

Diversification is often described as ‘putting your eggs into different baskets’. The combination of ‘baskets’ you choose depends on your goals, time frame, and risk tolerance. Long-term investors may choose more stocks, while shorter-term investors may select a more conservative mix, weighted toward bond and money market investments. No matter what combination you choose, make sure each fund plays a specific role in your overall objective. In investing, more is not always better– strategic diversification is the key.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not ensure against market risk.

Stocks of small companies involve greater risk than securities of larger, more established companies, as they may have limited product lines, markets and/or financial resources and may be exposed to more erratic and abrupt market movements.

© 2010 Standard & Poor’s Financial Communications. All rights reserved.