. . .

If you are reading this post, you have taken a crucial first step: You are facing the fact that you’re living on a reduced income. The most important thing you can do, when your income has been reduced, is to face the situation. Ignoring the issue, running from it, or putting off dealing with it will only make matters worse. So, congratulations, just by your thinking about how to handle this time in your life, you are more prepared than most people.

Below are some of the big questions you’ll consider, as well as some resources to help you find the answers:

1. What Money Do You Have Available Right Now?

Take a look at possible sources of money that are available to help you to get through this difficult time:

-Cash in bank accounts is an ideal source of money.

-Another option for acquiring funds is to sell stocks and/or mutual funds held in individual investment accounts; but, there are tax consequences for doing so — you will pay capital gains tax if there has been an increase in the value of the asset; and, you will take a capital loss if there has been a decrease in the value of the asset. Liquidating stocks and mutual funds in retirement accounts carries penalties and tax consequences. You should check with a tax professional before exercising any of these options.

-You could use your available limits on your credit cards to access money; but, this is not an ideal option, because the interest rates are very high, especially when you’re using a credit card to access cash. If you can use your credit card to cover expenses that you will be able to pay back within the month, with unemployment benefits or with money from a part-time job, this becomes a more palatable option.

-Borrowing money is often an alternative. There may be someone in a position to help you through this temporary situation. But, you should consider this option carefully. Paying back what you borrow will become crucial to maintaining your relationship with the lender.

2. What Money Can You Save?

Look at where you can cut costs: Can you decrease your food bills? Would you reduce your cable plan? Will you take public transportation (more regularly)? You may have set up automated bill payment or savings plans, to which you can no longer afford to contribute. It may be a good idea, at this time, to opt out of automatic bill payments, so you will have greater control over when you pay certain invoices.

But, don’t forget that: While you are trying to reduce your spending, one expense will increase . . . the money you will spend looking for a job. It takes money to drive, to park, to print, to buy new clothes for interviews and to attend networking events, among other things.

3. Time Your Inflows and Outflows of Cash.

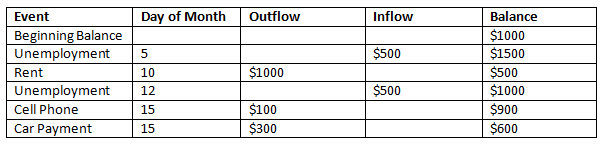

After you’ve culled through your expenses, you should create a monthly budget. Don’t only include bill amounts in your budget: also include information on when those bills are due. Think of paying bills as ‘outflow’; and, think of any money you receive as an ‘inflow’. By showing the days when you receive inflows, and when you will accommodate outflows, you can determine whether you need to delay the payment of bills to certain days. (See the table below for an example of a budget that has been arrayed in this fashion.)

If you’re now struggling to meet your obligations, call the customer service number found on your bills, and ask about options for making lesser payments and/or about paying bills on different days of the month. Remember that it is always an option to ask for a different payment date; but, you may also be able to change the payment amount.

4. Enjoy Your Life, Even Without Spending Money.

Remember that, although this is a trying time for you, it is only one part of your life; so, try to think of inexpensive ways that you can still do the things that you like to do. Perhaps it is time to try your hand at cooking more, because eating out is expensive. Universities, libraries, and bookstores hold free speaking events on a regular basis. Museums offer free admissions from time to time. Free concerts are held in all sorts of venues. You can check out DVD’s from the library, or download them onto your tablet. Keep up with your interests; a content person who does that is more likely to interview well.

5. Resources for Dealing with Limited Finances

For help, check out:

http://www.usa.gov/citizen/topics/family/help-for-difficult-financial-times.shtml

http://www.nfcc.org/